45+ 401k hardship withdrawal to pay off mortgage

There is a 10 penalty if you withdraw funds from your 401 K before you are 59 ½. Unlike a hardship withdrawal you will be able to pay off the loan plus interest back to your 401k account.

Investing Basics How To Be A Smart Investor Carbon Collective

Web A 401K Hardship Withdrawal Can Cost You More Than Once On the other hand 401k hardship withdrawal does not come without a price.

. Web 401k loan. Web If you are over age 59½ you are free to use your 401 to pay for anything you like. If youre overwhelmed by high-interest debt think 8 or higher taking out a 401 k loan could make sense.

Web Use 401 K to Pay Off Mortgage Without Penalty. You must report your withdrawal. 475 20 votes.

Best PDF Fillable Form Builder. A 401k loan must be paid back to the borrowers retirement account under the plan. Youre taking a loan to pay off high-interest debt.

Web A hardship withdrawal occurs when you pull money out of your 401k without paying the normal 10 penalty that is charged to individuals who are younger. Ad Edit Fill eSign PDF Documents Online. Thats a huge blow that makes paying down your.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Web An alternative to a hardship withdrawal is to take a 401k loan. Unlike 401k withdrawals you dont have to pay taxes and.

A hardship withdrawal from a 401k retirement account can help you come up with much-needed funds in a pinch. Web 2 hours agoAt the moment earnings from superannuation are taxed at up to 15 per cent that will increase to 30 per cent for around 80000 Australians on the portion of their. Web A hardship withdrawal is an urgent removal of funds from a retirement plan and is usually done in emergency situations.

If you are younger you can still withdraw funds from your 401 to pay off college. Web If youre under the age of 595 youll face an extra 10 penalty for withdrawing from your 401 k early. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Web If youre younger than 595 thats a 10 penalty for withdrawing early from your IRA or taking distributions from an employer-sponsored plan such as a 401 k or. Web 401 k Withdrawal for House Payments If you are planning on withdrawing money from your 401 k to fund a mortgage before you turn 55 it is almost inevitable. Conducting a hardship withdrawal is.

Web The amount of the hardship distribution will permanently reduce the amount youll have in the plan at retirement. You must pay income tax on any previously. Unlike a 401k loan.

If you are under then the.

What If You Always Maxed Out Your 401k

How Much Should I Have Saved In My 401k By Age

How To Retire Early All About Financial Independence Or Fire Hubpages

What S A 401 K Loan Or Hardship Withdrawal What You Need To Know

Sustainability Free Full Text The Power Of Financial Incentives Versus The Power Of Suggestion For Individual Pension Are Financial Incentives Or Automatic Enrollment Policies More Effective

Retirement Planning For The Self Employed

Should I Use My 401 K To Pay Off My Mortgage 5 Things To Consider Principal Com

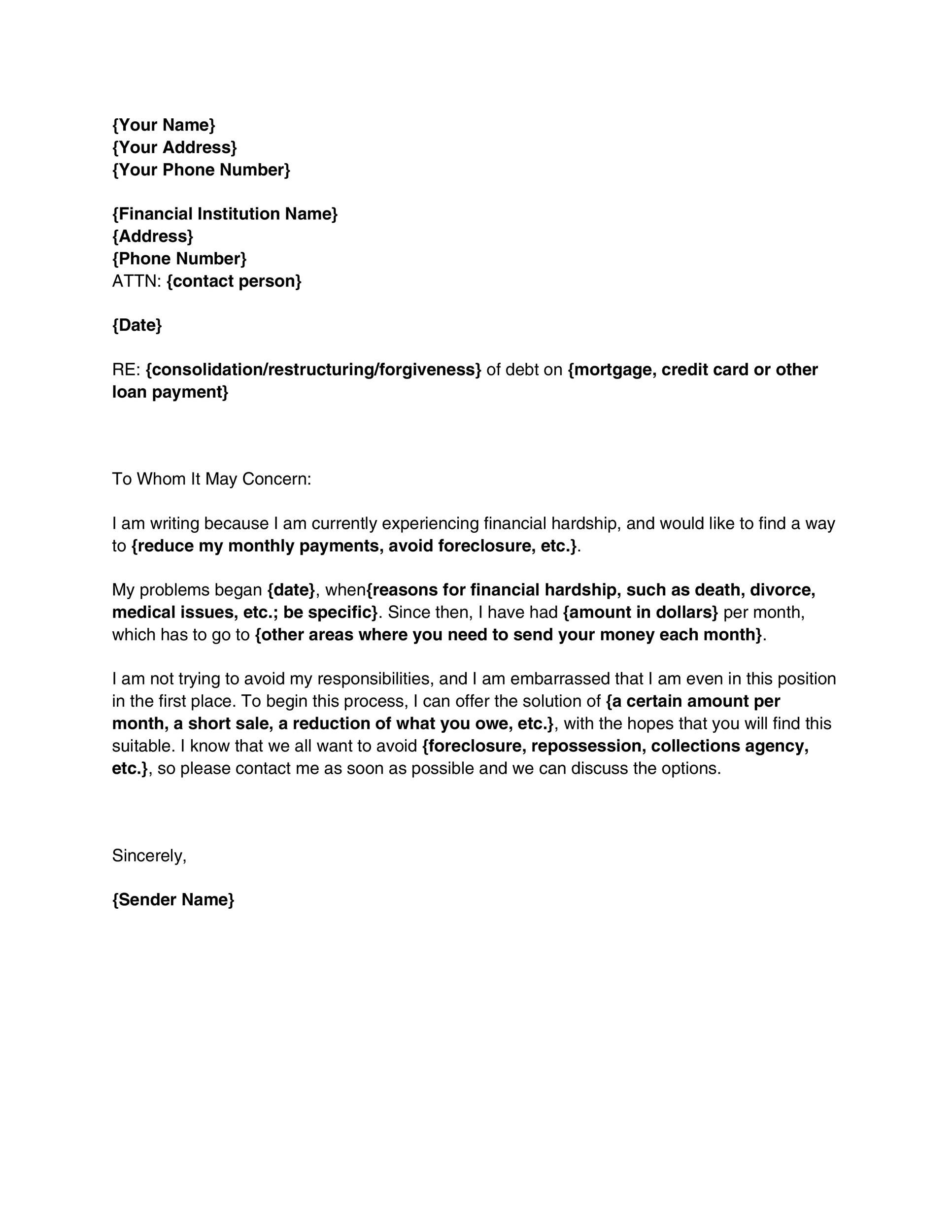

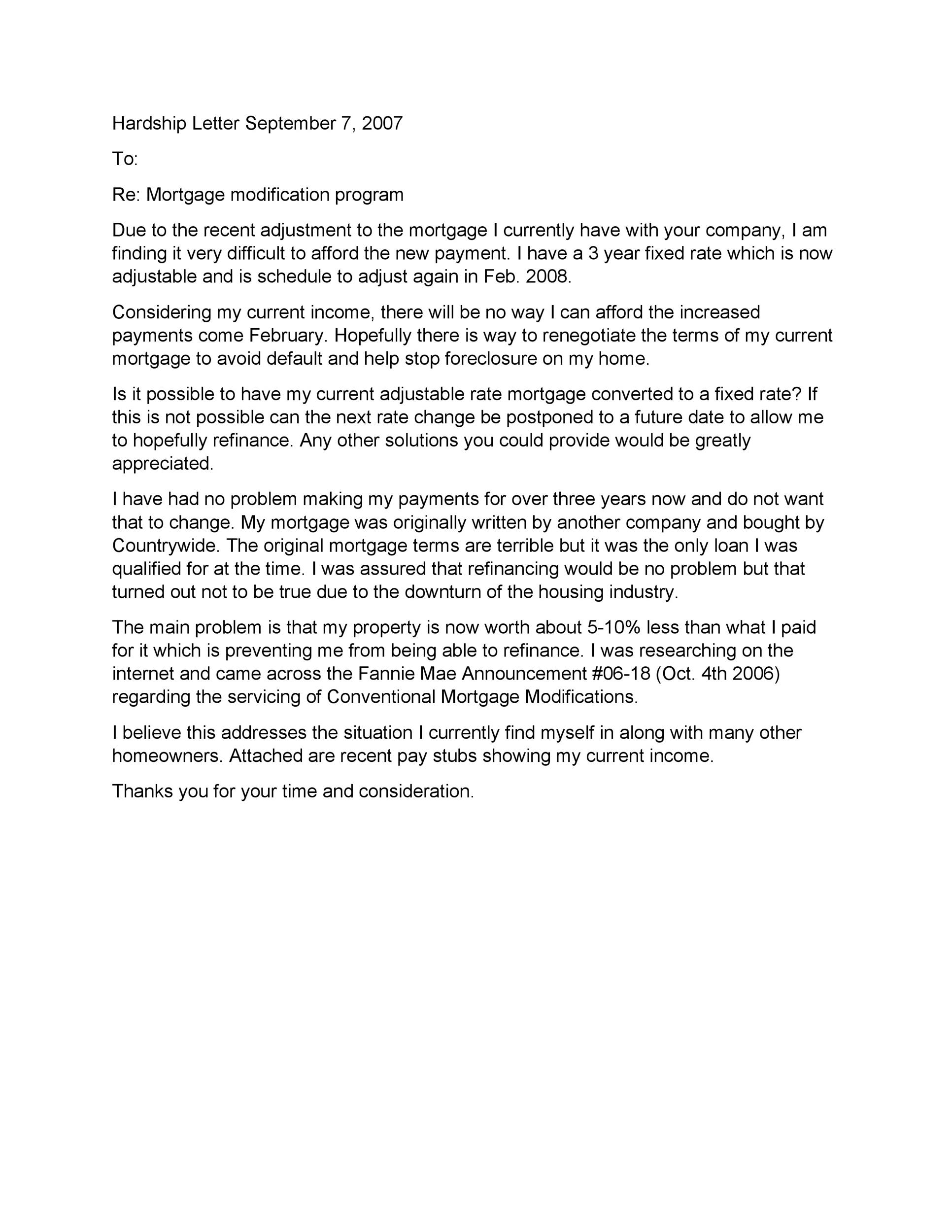

35 Simple Hardship Letters Financial For Mortgage For Immigration

Paying Off Mortgage Early The Good The Bad And The Ugly

The Suffield Observer November 2022 By The Suffield Observer Issuu

Retirement Wikiwand

Hardship Withdrawals Peak In August Operations Data Analysis Reveals Prudential

What If You Always Maxed Out Your 401k

What If You Always Maxed Out Your 401k

35 Simple Hardship Letters Financial For Mortgage For Immigration

Writing A Hardship Letter 401k Withdrawal Sample Hardship Letter

If You Started Maxing Out Your 401k At Age 27 And Retired At Age 60 With 8 Percent Growth Yearly How Much Would You Have For Retirement Quora